Loft Conversion Valuation – A Simple Guide

Thursday, 30th January 2020

Development | Licence to Alter | Surveying | Valuation

Here is our simple 3 part guide to valuing your loft space.

Part One – Who does this affect?

If you own a house or are the freeholder of your building, this blog does not apply to you. It does apply to you if you are a leaseholder who has a loft space above their flat and there is an opportunity to convert, often adding a further bedroom and en-suite bathroom.

Part Two – Why does this affect me?

In 9/10 cases, you will not own the loft space. You can check this by reading your lease but these are often so poorly worded that you should seek the advice of a surveyor or even a solicitor.

If are the 1 in 10 that do own, it is still not that simple. Leases can prohibit owners from undertaking alterations. Even if your lease states that you can, you will likely still need to cut into the external fabric of the building and that is owned by the freeholder.

If the freeholder can stop your conversion they can charge you a sum of money for their permission. This leads us to:

Part 3 – How do you value it?

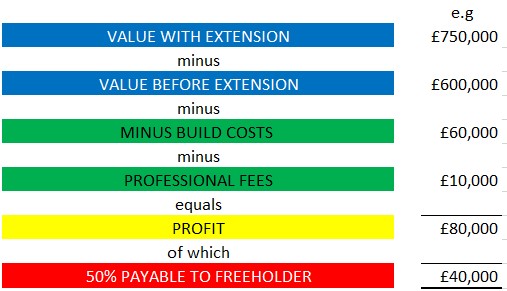

Whilst the calculation is not in any legislation the commonly accepted standard practice is:

This example has only 4 moving parts and small deviations can alter the final figure significantly. A report by a chartered surveyor would be considerably more detailed:

- Comparable sales evidence for before and after

- Detailed build costs (typically from contractors who have provided quotes)

- A breakdown of professional fees.

In the real world, it is the leaseholder who is taking all of the risks for the build, so it is also normal for a further deduction to be made to reflect this. The build cost only ever goes up. Never down!

Once the value has been agreed considerations such as party wall and licence to alter come into play so please click through to those pages if you would like some additional reading.