Valuing Lease Extensions and Enfranchisements of Houses

Thursday, 23rd February 2017

Leasehold Valuations | No Listing | Valuation

There is a lot in the news of late about the UK’s broken housing market. Spiraling house prices, unaffordable rents, poorly managed buildings, high service charges, ever rising ground rents and costly lease extensions increasingly favouring freeholders. The Government recently revealed its Housing White Paper which outlined how they intend to address many of these issues. So in the interim, are there any pieces of good news in favour of the humble common leaseholder? The answer is yes, but as always, there is often a catch.

Whilst relativity scarce, there are a number of leasehold houses to be found across London and the Leasehold Reform Act 1967 (the 1967 Act) that governs them does present opportunities to either extend the lease or enfranchise. The former, gives a leaseholder the right to an extension of an additional 50 years at a ‘modern ground rent’. Now a modern ground rent on a 1 million pound flat might well be determined at a yearly figure of between £15,000 and £20,000, representing a monthly outlay of £1,250 – £1,650 but here’s the good part: There is no premium payable for a lease extension and the modern ground rent only kicks in upon the expiration of the original lease. A truly great deal, in a world where you get nothing for free!

Whether or not you can do this first of all depends on the property’s initial qualification under 1967 Act. It must be a long lease, originally for a term of greater than 21 years or with a right to renewal. A qualifying tenant must be the leaseholder of the house at the date of application and must have held the lease for the past two years. In addition to this, where a leaseholder who has the right to extend dies, his representatives can serve a notice for within two years of the grant of probate or administration letters.

The most crucial (and often failed) test relates to when the tenancy was entered into and the rateable value at the date of commencement. We always recommend that a solicitor is instructed to review this. For the purposes of enfranchisement, the next step is to determine the valuation method. The 1967 Act provides two distinct bases for the valuation for which the above tests will determine which is applicable:

Section 9 (1) – the house will be valued according to the original valuation basis, i.e. value of the site.

Section 9 (1A), 9 (1C) – the house will be valued according to the special valuation basis, that is, the value of the house, including marriage value.

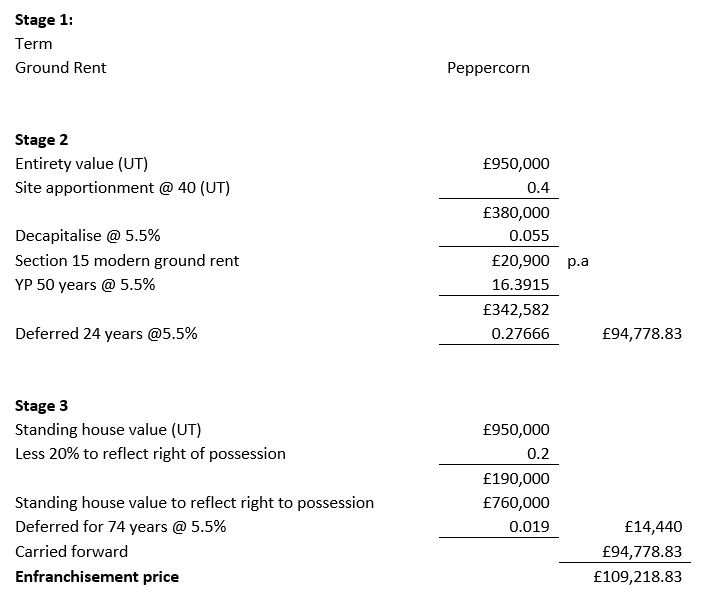

Section 9 (1A), produces a valuation methodology that is remarkably similar to an enfranchisement under the Leasehold Reform, Housing and Urban Development Act 1993 which isn’t exactly a giveaway! Section 9 (1) however, represents a substantial reduction in the premium, simply due to the way it is calculated. A typical example for a house held on a 24-year lease would be as follows:

Now for the purposes of this article it will be assumed that the inputs of the 1993 Act are reasonably well known (as it is very similar to an original valuation basis claim), but a similar claim could be in the region of £400,000. Unlike the previous method, there is now no assumption that the lease will be extended by 50 years and the qualifying criteria linked to the tenancy and rateable value applied to both extensions and enfranchisements. There’s no clever trick available whereby you extend your lease for free and then enfranchise under 1A. It is also often the case that the data required to prove the leaseholder can proceed with the more affordable option is either very difficult to acquire or is no longer available, leaving them with no choice by to pursue a more expensive enfranchisement.